child tax credit september 2020

New financial support measures. What Will be the.

Total Covid Relief 60 000 In Benefits To Many Unemployed Families

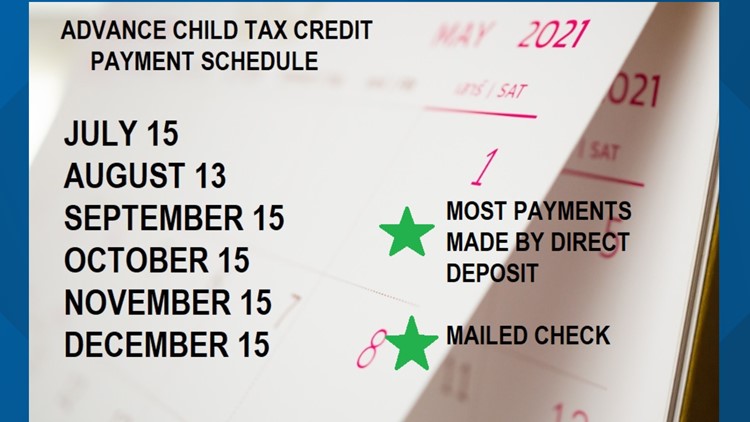

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving monthly Child Tax.

. Couples making less than 150000 and single parents also called Head. The 2020 Child Tax Credit is intended to help offset the tremendous costs of raising a child or children. Nearly all families with kids will qualify.

The IRS has made a one-time payment of 500 for a. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax. The enhanced child tax credit was valid through the end of December 2021 which means that the limits and amounts will revert to the 2020 tax credit rules.

The credit amount was increased for 2021. That drops to 3000 for each child ages six through 17. Specifically the Child Tax Credit was revised in the following ways for 2021.

This week the IRS successfully delivered a third monthly round of approximately 35 million Child Tax Credits with a total value of about 15 billion. The IRS is paying 3600 total per child to parents of children up to five years of age. The Child Tax Credit is a tax benefit to help families who are raising children.

The American Rescue Plan increased the amount of the Child Tax. However you may be able to claim a refundable Additional Child Tax Credit for the unused balanceUp to 1400 per qualifying child is refundable with the Additional Child Tax. Children born in 2021 make you eligible for the 2021 tax credit of 3600 per child.

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax. Families with a single parent also. You will get the additional one-time GST.

Thats up to 7200 for twins This is on top of payments for any other qualified child. Children born in 2021 make you eligible for the 2021 tax credit of 3600 per child. The Government of Canadas Affordability Plan includes an additional one-time GST credit payment.

Married couples filing a joint return with income of 150000 or less. So parents of a child under six receive 300 per month and parents of a child six or over receive 250 per month. The maximum amount of the child tax credit per qualifying child.

We are aware of instances. The maximum amount of the child tax credit per qualifying child that can be refunded even if. September 26 2022 Tax Credits.

It is a partially refundable tax credit if you had earned income of at least 2500. These people are eligible for the full 2021 Child Tax Credit for each qualifying child. For parents and guardians of dependent children the Internal Revenue Service IRS provides a tax credit that can help reduce your tax liability for.

Half of the total is being paid as. Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News.

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Expanded Child Tax Credit Continues To Keep Millions Of Children From Poverty In September A Columbia University Center On Poverty And Social Policy

Missing September Child Tax Credit Payments Some Parents Have Yet To Receive The Funds Cnn Politics

Axne Led Provisions Included In Final Version Of Covid 19 Relief Deal Advanced To President S Desk Representative Cynthia Axne

U S Energy Information Administration Eia Independent Statistics And Analysis

Part Ii Premium Tax Credits Beyond The Basics

The Irs Will Be Sending Parents Monthly Payments In One Week Wfmynews2 Com

Biden S Child Tax Credit Plan Points To Progressive Agenda

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Saas Startups 3 Best Practices For Documenting R D Tax Credits With Git Data

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

What Is The Child Tax Credit And How Much Of It Is Refundable

/cdn.vox-cdn.com/uploads/chorus_image/image/70051134/1235261204.0.jpg)

Child Tax Credit Extension Democrats May Lose Their Best Weapon Against Child Poverty Vox

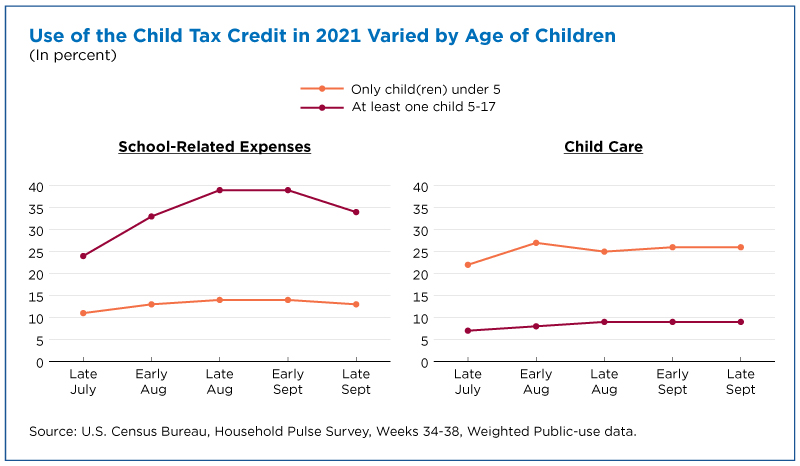

Nearly A Third Of Parents Spent Child Tax Credit On School Expenses

Understanding Economic Impact Payments And The Child Tax Credit National Alliance To End Homelessness

The Covid 19 Pandemic Underscored The Child Tax Credit S Power To Alleviate Family Poverty Urban Institute

Missing September Child Tax Credit Payments Some Parents Have Yet To Receive The Funds Cnn Politics

Tax Tip Irs Statement On September Advance Child Tax Credit Payments