food tax in madison

Kristi Noem to call a special legislative session to repeal the states tax on. While Wisconsins sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

A1 Tax Financial 414 Donofrio Dr Madison Wi Yelp

All counties in the region assess an additional 05 county tax rate for a total sales tax of 55 below the national median of 595.

. What is the sales tax rate in Madison Wisconsin. Taxable Sales Line 1 minus Line 2 4. Food Licensing Permit pdf click to view Approved Certified Food.

The Wisconsin state sales tax rate is 5 and the average WI sales tax after local surtaxes is 543. Food and beverage tax collections in Madison County over the past four years. The minimum combined 2022 sales tax rate for Madison Wisconsin is.

Sales and Use Tax. This page describes the taxability of. Madison Virginia on each person a tax at the rate of four.

In addition if a restaurant or bars. Madison County Food and Beverage Tax IC 6-9-26-1. OTHER LOCAL TAXES CHAPTER 26.

Anderson gets 70 percent of the funding and the remainder of the county receives 30 percent. The Indiana Department of Revenue DOR provides the food and beverage tax rates for each county or municipality in the table below. Jamie Smith the Democratic candidate for governor challenges Gov.

COUNTY OF MADISON n Final Return 1. Pam Merchant D-Brookings introduced a bill to provide for the reduction of the sales and use tax on certain food items House. Gross Sales of Prepared Food Beverage 2.

The City of Madison collects the following types of taxes. Groceries and prescription drugs are exempt from the Wisconsin sales tax. The food and beverage tax generated approximately 2 million for the county in 2020.

Madison wi sales tax rate. You can view your 2021 tax information by accessing your account via account access. The FOOD and BEVERAGE TAX for MADISON COUNlY VIRGINIA WHEREAS Virginia Code Section 58l-38B33 et seq 1950.

101 West Main Street Suite 115. However counties and jurisdictions may charge an additional local. Follow Ken de la Bastide on Twitter KendelaBastide or call 765-640-4863.

You may also contact your county auditors office to. The Wisconsin statewide sales tax rate is 5. Leaders to vote on.

Food Tax In Madison. South Dakota state Rep. In most cases prepared food to be consumed on or off the premises is fully taxable in Alabama at 4.

Gerald Lange D-Madison and Sen. This is the total of state county and city sales tax rates. Complete the Application for the City of Madison.

Food food ingredients and beverages that fall under one or more of the above categoriesare pr epared food and subject to Wisconsin sales and use tax. Madison VA 22727 MAKE CHECK PAYABLE TO. MADISON COUNTY FOOD AND BEVERAGE TAX IC 6-9-26 Chapter 26.

Photos Eleven Madison Park Plant Based Menu Review

Wisconsin Sales Tax Calculator And Local Rates 2021 Wise

Illinois 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Taco Bell In Madison Restaurant Menu And Reviews

I Might Have Eaten The Meal Of The Future It Cost 270 And Left Me Hungry Grist

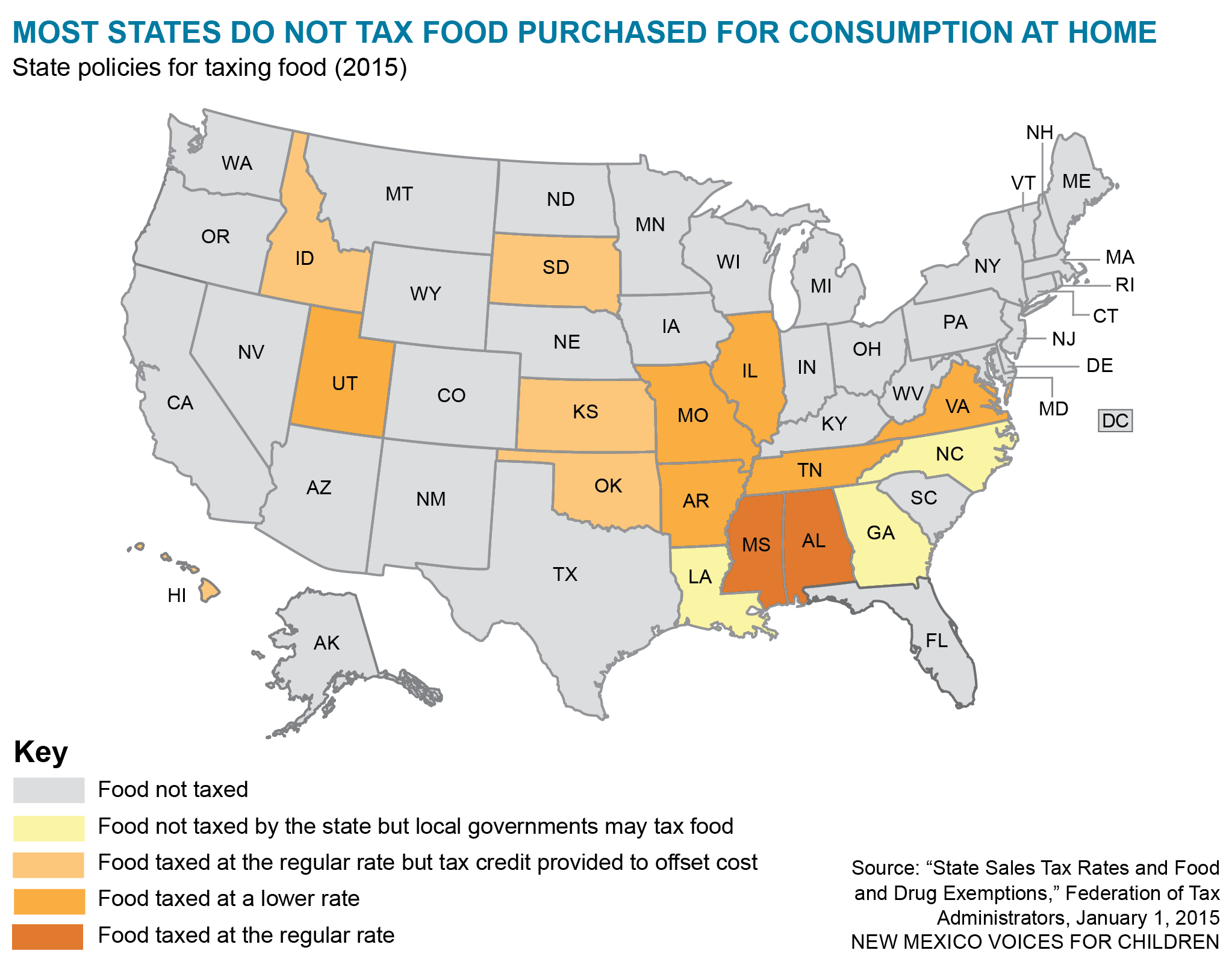

State Sales Tax On Groceries Ff 09 20 2021 Tax Policy Center

A Health Impact Assessment Of A Food Tax In New Mexico New Mexico Voices For Children

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

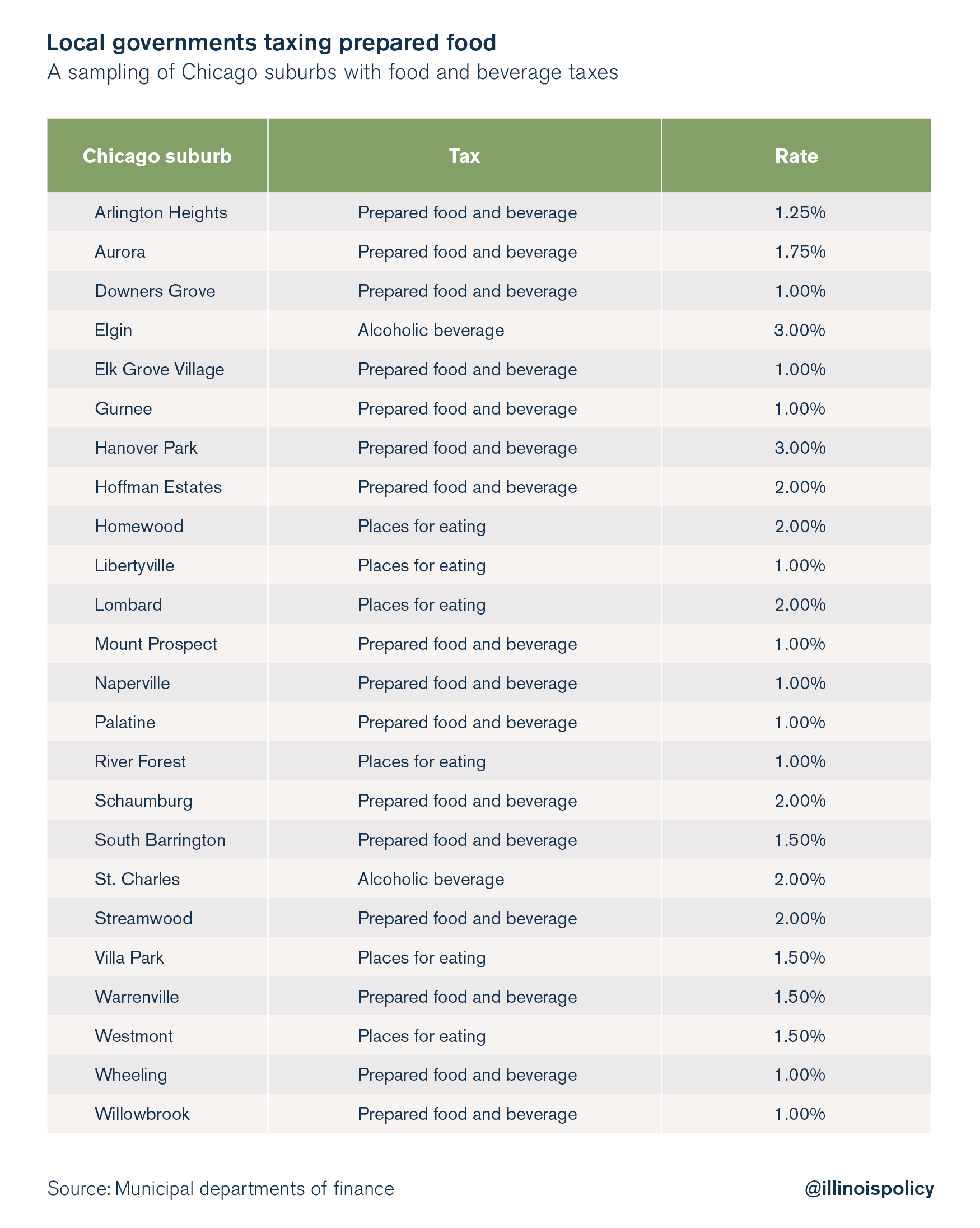

Chicago Suburbs Eye New Dining Alcohol Taxes

Social Services Madison County Ny

Madison Adult Tlc Residential Care Home Cleveland Oh 44102

Do Tax And Budget Reforms Spell Doom For Accountants In Business Madison

![]()

United Pet Fund Pet Food Drive Cincypet Magazine

November 6 Tamale Cooking Class Updates District 18 Common Council City Of Madison Wisconsin

Madison Eyes Revamp Of Downtown Parking Lot Madison Eagle News Newjerseyhills Com